Explain the Main Differences Between Regressive and Progressive Tax Systems.

A progressive tax imputes a higher percentage of taxes to higher income levels and is based on the theory that people with high incomes manage to pay more. As against this in the case of a regressive tax.

Tax Rates And Poverty Syllabus Aims Students Should Understand The Possible Link Between Changes In Tax Rates And Tax Revenues Ppt Download

In contrast to it regressive tax system is the arrangement where the tax to be paid is uniform in nature.

. With regressive taxes the lower your income is the higher the percentage of income you will pay. Which type of tax would be better for taxpayers. This is known as a regressive tax because it has a larger percentage impact on lower income individuals.

The difference between progressive regressive and proportional tax systems lies in how the government assesses a taxpayers tax liability or obligation. A the current federal personal income tax system b a local 25 income tax and c the current FICA social security tax system. The main differences between a flat regressive and progressive tax plans is that the flat tax you pay the same amount even if the price of the good increases applies for everybody a regressive tax is the one that decreases if the amount of money you make increases and the progressive tax is when the tax increases if the amount of money you make.

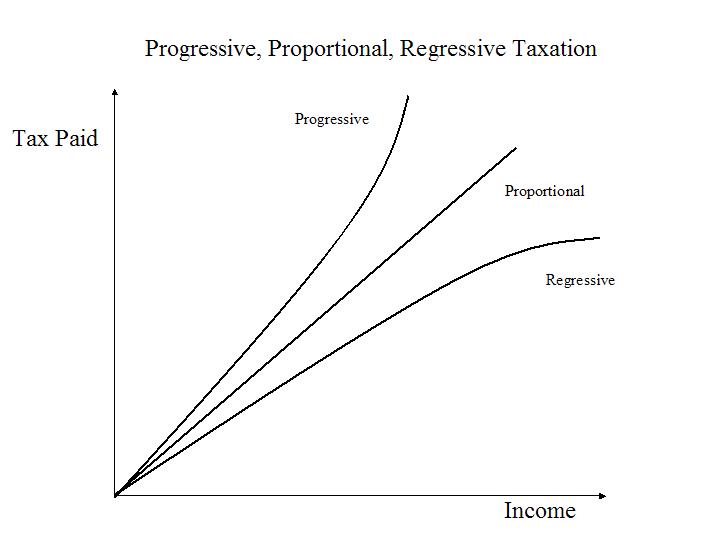

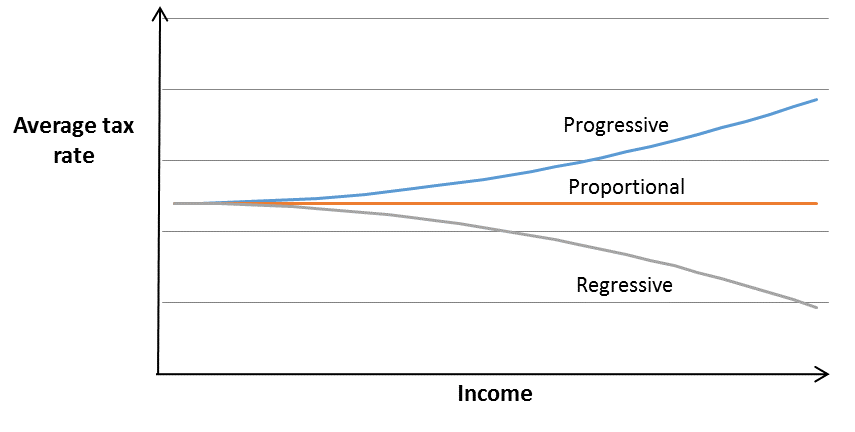

In progressive tax marginal tax rate is greater than the average tax rate. Weve got the study and writing resources you need for your assignments. What is the difference between regressive and progressive taxes.

Low-income people pay a higher amount of taxes compared to high-income people under a regressive tax system. Progressive taxes increase based on your taxable income. Progressive taxes are the opposite of regressive taxes.

The GST is 017 of the retail workers income The GST is 003 of the doctors income. That role continued until the late 1970s when inflation began to hurt the economy. Tax systems in the US.

Scans of internal organs using magnetic resonance imaging MRI. An example is state sales tax where everyone pays the same tax rate regardless of their income. Progressive tax includes all direct taxes while regressive tax covers all indirect taxes.

Progressive taxes are the opposite meaning the percentage of your income that you pay increases as your income increases. There are two types. Regressive Comparable and Progressive Taxes.

Government promoted regulation during and after the Great Depression. Regressive proportional and progressive and two of the three meaning high- and low-income earners differently. What type of tax structure represents.

A regressive tax is the opposite of a progressive tax because you pay a higher tax rate as your income decreases. A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. A progressive tax system refers to the tax system where the tax rate to be paid increases with the increase in the income.

A progressive tax is a tax where the tax rate increases with increase in the taxpayers income. Most state income taxes have a similar progressive structure. The average tax rate is lower than the marginal tax rate.

Higher-income taxpayers pay a smaller percentage of their income than lower-income taxpayers because the tax is not based on ability to pay. Finally proportional taxes result in everyone paying the same portion of their income in a tax. Fall into three main categories.

Progressive taxes are the opposite of regressive taxes. A regressive tax does not take into account an individuals income level or ability to pay but it is not exactly the opposite of a progressive tax. Tax burden of the taxpayer also goes up when the tax is progressive.

Project and Analysis Questions Points listed by each question 5. Start your trial now. A progressive tax is a tax in which the tax rate increases as the taxable base amount increases.

The average tax rate is higher than the marginal tax rate. The GST is 017 of the retail workers income The GST is 003 of the doctors income. Progressive taxes increase based on your taxable income.

Find an answer to your question Explain the difference between progressive taxes and regressive taxes. Here individual who get high income pay higher proportion of there income as tax. In progressive tax system the assessees ability to pay is considered.

Solution for What is the difference between progressive and regressive tax system. Frequently this is seen when the tax is applied to transactionslike a sales taxand increases the total cost of something. As you explain each one also compare the relationship between marginal tax rate and average tax rate as income rises for each one.

Beccaboles beccaboles 12042017 Social Studies College answered expert verified. Progressive Tax Systems A progressive tax system means the proportion of income paid in taxes increases as the taxpayers income increases. This is known as a regressive tax because it has a larger percentage impact on lower income individuals.

Regressive taxes have a greater impact on lower-income individuals than the filthy rich. Explain the difference between a progressive tax system a regressive tax system and a proportional tax system. Decide which of these tax structures is represented by.

A regressive tax system levies the same percentage on products or goods purchased regardless of the buyers income and is thought to be disproportionately difficult on low earners. Unlike regressive tax wherein the tax payers level of income does not matter at all. First week only 499.

On the other hand in the case of regressive tax tax rate decreases with increase in income. A regressive tax is the exact opposite.

What S The Difference Between Progressive And Regressive Taxes Youtube

Resourcesforhistoryteachers Progressive Proportional And Regressive Taxation

Progressive And Regressive Taxes

Brief Progressive And Regressive Taxes Austaxpolicy The Tax And Transfer Policy Blog

No comments for "Explain the Main Differences Between Regressive and Progressive Tax Systems."

Post a Comment